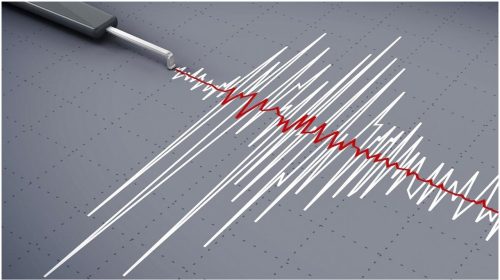

Climate change is no longer a looming threat described in scientific projection. It is a disruptive force actively reshaping the economy, industry and community. Few sectors are feeling this shock more intensely than the global insurance industry, which now stands at the intersection of rising visible danger and growing economic instability. What was once an industry built on predictable risk has been thrust into a world where unpredictability has become the new norm.

In the United States, a single year of climate-linked catastrophes produced eighteen separate events, each exceeding one billion dollars in losses. This staggering figure is indicative of a deeper global crisis: climate disasters are increasing in both frequency and intensity at a pace the insurance sector’s traditional model was never designed to absorb. Insurers that once relied on historical weather patterns to calculate risk are now being blindsided by extremes that fall outside every precedent.

As claims surge, companies are dealing with a double economic squeeze. Rising payout threatens profitability, while climate-vulnerable real estate and infrastructure are losing value, eroding insurers’ long-term asset bases. Regions once considered safe- from inland suburbs to forest-edge communities- are now experiencing flood, wildfire and destructive storms. In some high-risk areas, insurers have begun withdrawing entirely, leaving homes and businesses effectively uninsurable. This withdrawal sends shockwaves into the real estate market, banking system and local economy, raising the specter of a broader economic contagion.

Yet amid this instability, technology is emerging as a lifeline. Insurers are increasingly relying on predictive analytics, machine learning and geospatial modeling to anticipate evolving risks with greater precision. Automation is transforming underwriting and claims processing, allowing companies to handle surging caseloads with greater speed and lower cost. These innovations are becoming vital tools for survival in a rapidly shifting climate landscape.

Still, no amount of technological sophistication may compensate for the absence of stronger climate policy and resilient infrastructure. The insurance crisis emphasises a larger truth: climate change is not merely an environmental challenge but a financial reckoning. Without coordinated action from managements, regulators and global institutions, the economic system underpinning modern life may face deeper fracture. The future of the insurance sector and the global economy it helps stabilise- depends on whether the world responds to this warning with urgency rather than regret.

Writer: Raj Kiron Das is currently working at Insurance News BD. Previously, he served as a Sub-Editor at Somoy Television’s English Web Desk and later as an Editorial Assistant at Bangladesh Post. He is also the Founder of the Equal Rights Organisation (ERO) and can be reached at ragbirajmcjru@gmail.com